If you are importing to the United States there are several procedures that you should be aware of. One of them is paying duties and taxes according to the dedicated HTS code. So what is the HTS code?

Simply put HTS code stands for Harmonized Tariff Schedule. These codes determine the US import tax rate of your product and can be found on the official website here. If you want to know more about calculating your import tax rate I’ve written about the subject extensively here. But let’s dive deeper into the HTS codes and what they stand for.

Disclaimer: Some of the products may contain an affiliate link and we may make a commission if you click on it at no additional costs to you.

WHAT IS AN HTS CODE?

As I’ve said above an HTS code is a code that determines your import tax and duty rate. These codes are issued by the US International Trade Commission and can be found on their website. These codes are 10 digits long. Each digit has a certain meaning and I’ll give you an example below:

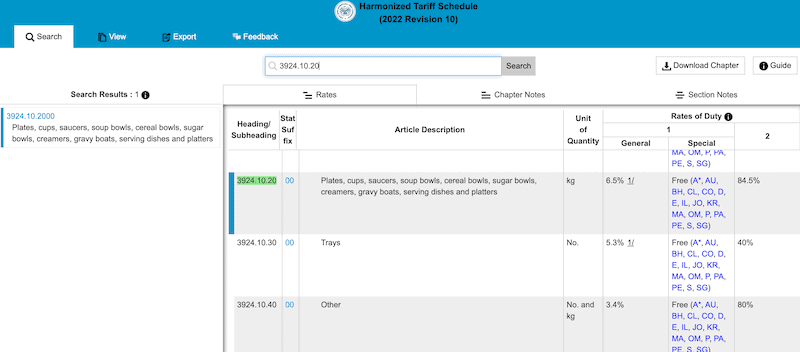

In above example I’ve looked up a salad bowl made out of plastic. The first two digits (39) stand for the Chapter, e.g. household articles in this case. The next 2 digits stand for the Heading (24), kitchenware. Then the next 2 digits stand for the Subheading (10), plates, cups bowls etc. Then we have another 2 digits for another subheading (20) that stands for the material in this case (plastic). The last 2 digits (00) are the Statistical Suffix in this case. As you can see we can determine the Import Duty as 6,5% for our plastic salad bowl.

As an example, if you were to import salad bowl with the value of $1000, you import duty and rate would be $65. This would not include merchandising process fees, insurance etc. Which is usually determine by your freight forwarder.

But if you just wanted to look up the cost of your duties, this would be the simples form to check. Now, the official website has all data, however sometimes it is difficult to look up the actual code for your product. I like to refer Freightos over here, who have a great and simple import duty calculator too.

WHAT IS THE DIFFERENCE BETWEEN HS AND HTS CODES?

HS codes are 6 digit numbers that are issued by the World Customs Organization and are used by customs all around the world. At least 97% of all customs around the world use these codes. In most cases specific countries add the additional 4 digits for their country and they may differ from country to country.

It is important to note that as an importer in the US for example you need to use HTS codes and not HS codes. HS codes are mostly used internally by customs and not by customers or importers.

[thrive_leads id=’51377′]

WHAT ARE SCHEDULE B CODES?

Schedule B codes are also 10 digits long and are used to EXPORT products from the United States, not to import them. Normall the first 6 digits are the same as HTS codes, however the last 4 digits can alternate. As an importer you are required to use HTS codes.

WHAT IF I HAVE THE WRONG HTS CODES?

Generally speaking it is quite easy to lookup your HTS codes. And in many cases your supplier should have them as well since they’ve probably exported their goods to the US before. So it shouldn’t be an issue for you to get the right codes. Also most freight forwarders have the right codes and technically you do not need to worry about getting the right codes for your products.

However if you do intentionally use the wrong code, for example to lower your import duties, you may face penalties, seizure of your import or harsher consequences. So certainly I do not recommend doing that. Always use the proper code not the one that may give you an advantage in fees.

Again, many stations in your supply chain (e.g. your supplier, your forwarder) should know the correct codes. But if you really need help you can get help either on the official website HERE or get help with sites like Freightos here.

I hope above helps you!