If you’ve ever been wondering how much tax and import duty rates you have to pay on your imported product you’ve come to the right place. Whether as a private individual or as a company, there are several things to consider.

It may seem complicated at first but it’s actually not. Once you know your customs tariff number (also called Harmonized Tariff Schedule or HTS) you can actually calculate it yourself. You can find the customs tariff number over at the official site HERE. So before importing a product to the US you may want to find your customs tariff number first. Admittedly it’s not easy to navigate on the official site but once you got the hang of it you’ll be fine.

A simple way of calculating us import tax and duties is via a customs duty calculator. There are several available on the internet but Freightos has one that works perfectly over HERE.

You may have also have heard that anything below “$2500” doesn’t get taxed? Partially true. Let’s look at import duty rates & taxes for the US in detail below.

Let me give you a brief overview of what I mean and then go into detail for each scenario.

Disclaimer: Some of the products may contain an affiliate link and we may make a commission if you click on it at no additional costs to you.

INFORMAL ENTRY

An informal entry is the entry of goods valued under $2500 and does not need to be cleared by a customs bond as it is designated for mostly personal importations. The amount used to be $1000 before 2013 but the threshold has since been increased to $2500.

FORMAL ENTRY

A formal entry is the entry of goods valued over $2500 and needs to be cleared by a customs bond. This type of entry is used for commercial importations only (e.g. re-selling goods on Amazon). For this scenario you may need a freight forwarder like DHL or a third party logistics company to clear your shipment.

LOWERING PRODUCT COSTS ON INVOICES TO AVOID TAXATION & RATES (NOT RECOMMENDED)

This tactic is used to avoid taxation which I certainly cannot recommend since you are basically committing a felony. I explain in more detail below.

IMPORTANT EXCEPTIONS ON TEXTILES

There are also exceptions on textiles which I’ll discuss below.

If you are new to eCommerce or even been hanging around for a while, the word in the community is that anything below $2500 doesn’t get taxed and no rates apply. Unfortunately that is completely wrong.

First of all any amount is technically taxable if the product is intended to be re-sold but the US customs and border protection calls the entry with a value under $2500 an informal entry. An informal entry are “goods for personal consumption or enjoyment”.

Now in most cases customs turns a blind eye and won’t tax or slap rates on your products imported under $2500. That is if the actual declared product value makes sense. What does that mean? Lets look at two example:

INFORMAL ENTRY EXPLAINED

Let’s imagine 2 scenarios. Scenario 1, you want to order a yoga mat on Aliexpress for personal use and you do not intend to re-sell it. It costs $40 including freight costs. Since the US allows for the duty-free importation of personal-use articles when the fair retail value of such goods is under $2500 you do not have to pay import tax and duties.

In scenario 2 I want to buy a product on Alibaba and resell it on eBay or Amazon. Let’s imagine we stick with the yoga mat and my actual product costs are $20. and I order 20 pieces as a test. The total order is therefore valued below $2500. This would technically be still called an informal entry but my actual plan is to re-sell them.

But customs doesn’t know that I intend to re-sell them and since there is a threshold of $2500 anyway, they often don’t impose any tax or duties. Now I technically have to pay taxes and duties because I am importing as an individual or entity with the intent to re-sell these goods. And that is the keyword here: intent to re-sell.

Having said that, customs doesn’t know I intend to re-sell them, it doesn’t mean that you aren’t liable to pay us customs duties and taxes. Because if you import 20 pieces of a private labeled yoga mat it is very likely that customs knows that you have the intent to re-sell these goods.

However, as I mentioned US customs turn a blind eye in many cases and release your goods without having to pay any taxes and duties (just don’t count on it and calculate duties and taxes anyway when calculating your profit margin).

This happens especially (customs turning a blind eye) if you use couriers like DHL, UPS etc. because they have a special clearance lane and customs often “wave these goods trough”.

Now if you were to ship by a freight forwarder (Sea or regular Air freight) because for example 20 yoga mats are heavy and expensive to ship by air, the freight forwarder that you hire has to file for a Informal Entry and you will very likely be taxed according to the customs tariff number.

FORMAL ENTRY EXPLAINED

Now let’s say I plan to re-sell a larger quantity of private label products. Let’s imagine my actual product cost is $6 per piece to manufacture and I order 500 pieces.

I declare $3000 total order value on my Invoice which means I or my freight forwarder/carrier has to file for a formal entry. I get taxed at the import rates and duties as filed under the official US Harmonized Tariff Schedule, which again you can find HERE.

Let’s say for example my product is the famous “Garlic Press”. I do research on the HTS site and find out that the garlic press has an import duty rate of 3%. Therefore the import duty amount to the US is $90 (3% of $3000).

There will be merchandising processing fees as well that are usually a couple of dollar. In total I won’t be paying more than roughly 100-120$ for import rates and duties.

I am happy to pay that amount and import my product in a fair and square manner.

[thrive_leads id=’51377′]

LOWERING THE PRODUCT VALUE ON THE INVOICE (NOT RECOMMENDED)

Now a lot of sellers/buyers manipulate their product price on the invoice that the supplier issues to avoid any taxation because they have heard of the “$2500 rule” but they aren’t aware of the actual regulation (informal/formal).

They do that because they have heard from other people in Facebook groups that they do that as well and they got away with it. Or their supplier told them that they will lower the invoice to help them save costs…. Please don’t!

Say for example someone imports a product and manipulates the invoice from the supplier from a $6 product to a price of $4$ instead to stay below the informal entry $ threshold. In most cases customs will not check and therefore that person can import said products “if they are lucky” at a zero percent tax rate since it is an informal entry.

While I don’t encourage you to do so, this procedure is very common and customs is aware of it. I guess the US supports their economy and has better things to worry about.

However If you greatly underprice your item you can get in trouble. Say for example that the supplier issues the invoice at $1 (or even less) to make the total amount out to less than $500$ (for 500 garlic presses). How would you explain to customs, that your 500 pieces of private label garlic presses are for personal consumption? How will you explain that a product that sells for 15-20$ is being imported by you for 1$ a piece? You can’t and you will likely be taxed the full amount as well as a fine for deceiving customs.

Those fines can be in the excess of thousands of US$, depending on the product and the circumstances of the case. Also bear in mind that the assessment of the total product value, is often at the opinion of the customs officer on duty at the time.

They aren’t stupid and if a product obviously has a higher value than you have declared, they will definitely slap you with the full import rate and/or a possible fine.

In order to avoid any mix up with the correct customs tariff number I recommend you to tell your supplier to mention the correct number. If you aren’t sure which one is the correct number look on the official Harmonized Tariff Schedule Site HERE.

If you still can’t find it then you can also call the phone number on the customs tariff website and they will give you this information for free. So I’d definitely recommend you to declare the real value and if you really must to save a few $… lower the price to a reasonable price. (E.g. $5.5 instead of $6). But you haven’t heard it from me…

I personally declare the real value because it’s simply not worth to falsify a customs invoice to save 90$ of taxes (as in above example).

IMPORTANT: SAMPLES ARE A DIFFERENT SCENARIO

Let’s imagine you want to become a re-seller on Amazon or even your own shop. So it is completely normal to order a sample for your evaluation. You actually should declare your samples at a low or NO VALUE at all because again, they are simply for your evaluation and order decision. You will most likely not re-sell that sample anyway.

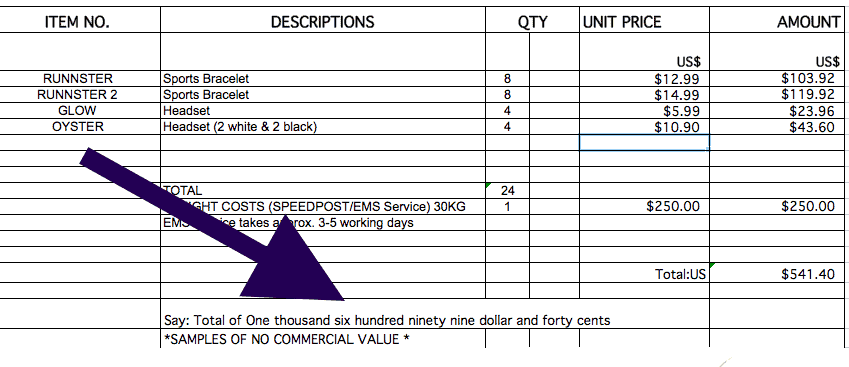

Therefore you can declare samples at a nominal value (1$) and mention on the sample Invoice: “Samples Of No Commercial Value”. Your supplier can put this on the sample invoice for you. See an example below:

HOW DO I DECLARE INFORMAL OR FORMAL AND HOW DO I PROPERLY FILE THIS WITH CUSTOMS?

You don’t have to worry, your logistics company will declare that for your. This could be a freight forwarder or a courier like DHL.

In any event, the forwarder/courier knows the amount of total product value and will know how to declare for you.

IMPORTANT EXCEPTIONS ON TEXTILES

IMPORTANT: There are exceptions to the 2500$ rule!

One exception to the “valued under $2,500 rule” includes textiles. For this type of trade-sensitive merchandise, a lower value of $250 applies. A variation, or subcategory, of informal entry is known as “Section 321” which allows the duty-free entry of merchandise valued at $200 or less – as long as it is imported by one person on one day.