Two of the questions I receive the most is: “Can I sell on Amazon US as an international seller” or “Can I send my order directly from the factory directly to Amazon”? and “Can I ship from China to US directly?”

Yes you can!

This prompted me to do a write up on the topic and without further ado, here’s a quick guide for you that hopefully answers your questions:

You basically have four options:

- Using a customs broker acting as the ultimate consignee (No EIN needed)

- Using a courier service like DHL/UPS/FedEx etc.. I personally recommend FedEx (Amazon’s EIN recommended)

- Using a prepping and forwarding company that acts as the ultimate consignee (NO EIN needed)

- Using a forwarding company/customs broker when delivery by regular Air or Sea shipment (not by courier) and acting as the Importer of record and ultimate consignee yourself (Amazon’s EIN needed)

In all cases I still recommend you to get your own US Tax Payer Number or also commonly referred as EIN.

Simply follow this link for information and call the number mentioned under “Apply by Telephone – International Applicants”. It’s a very simple and straightforward process that takes about 10-15 minutes.

https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/How-to-Apply-for-an-EIN

Some important reminders:

Disclaimer: Some of the products may contain an affiliate link and we may make a commission if you click on it at no additional costs to you.

1) Not all customs brokers can act as the ultimate consignee. The ones that do usually offer services on top to act as your ultimate consignee:

2) Very Important: Never put Amazon as Importer of Record on any document. In case you send goods directly to Amazon only use them as the ultimate consignee but never as the Importer of Record otherwise they will definitely reject your shipment.

3) One thing that is super important if you decide to send products from China to Amazon without any stop in between (Prepping, Labelling or Quality Control company in the US):

HAVE AN INSPECTION. I can’t stress enough how important it is to have an inspection before sending anything to Amazon directly.

I know that many buyers have an inspection in the US. But what if the goods are defect to such an extent that you can’t rework them in the US? Are you going to send them back to China? Unlikely.

Save yourself this step and have the inspection in China with a reputable Inspection company like QIMA

If there’s anything wrong during the inspections you can still have them re-worked in the factory directly.

On top of that you protect your initial deposit to the factory by having an inspection.

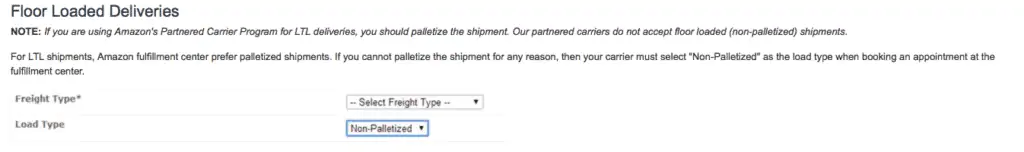

4) Also make sure you comply with Amazon’s packaging and labeling requirements (weights, labeling & carton measurements). Amazon’s fulfillment centers prefer palletised shipments but you do have an option to send the shipment un-palletised. There will be an option in Seller Central when you create your shipment that allows you to choose the option of un-palletised shipments.

5) Do as much labelling and prepping in the factory as possible!

Your factory can take care of all the labels and prepping needed for Amazon, you simply need to give them clear instructions when you place your order.

6) Think hard about “inventory placement” that lets you ship from China to one Amazon warehouse only.

This costs 0.3$ on top of the product cost but it might be worth it considering that you only have to invoice once. On top of that shipping companies charge extra for each set of documents on various levels and it is complicated to instruct your supplier to ship to 2-3 different warehouses. Think about all the labelling and coordination that has to be done with the supplier. However if you ship to multiple Amazon warehouses, have each order palletised for each warehouse while in China, so that you’re not using U.S. labor to de-consolidate a shipment and re-palletise goods. You’ll also have to book the ground shipments after your ocean shipment has arrived, which adds complexity to the process

Lets look at each option in detail:

1) USING A CUSTOMS BROKER ACTING AS THE ULTIMATE CONSIGNEE

There are several companies in the US that can act as your customs broker and ultimate consignee. If they offer to be a ultimate consignee they usually add a few services on top that they are looking to sell to you such as:

- Clearing customs

- Receiving cartons (LCL, LTL or FedEx / UPS / DHL etc.)

- Apply shipping labels

- Ship to Amazon

- etc.

This can add up in costs on top of your product but they’ll make sure that items are properly packed, labelled and cleared by customs as an ultimate consignee.

I’ve been contacted by Rakuten Super Logistics a Third-Party Logistics (3PL)/Prepping/Customs Brokerage company based in the US and they had such a detailed process lay down in PDF that I decided to post them (with permission). Credit of the following content goes to Rakuten Super Logistics however please note the entire process is the same for other 3PL companies as well.

Why do I need a Customs Broker?

If your shipment is arriving by Regular Air Cargo (not by DHL, UPS, or FEDEX) or Ocean cargo, you will need a Customs Broker to clear the shipment on your behalf. All shipments must be cleared through Customs. Certain commodities are also subject to the regulations of other government agencies such as FDA, USDA, DOT and EPA. Please check with your Customs Broker for import requirements. Please do not ship without doing your research!

What type of Services do 3PL companies offer?

- International Freight Forwarding (Shipping) – by Air and Sea

- Customs Brokerage

- Domestic Delivery from port to final US destination

- Amazon FBA prepping

- Warehousing

Should I use Ocean or Air Shipping?

Your decision should be based on how quickly you need your shipment and how much you’re willing to pay.

- Ocean shipments are less expensive but take longer to arrive. The costs are generally 1/2 – 1/3 the costs to ship by air. You should figure approximately 3 – 4 weeks’ lead time.

- Air shipments are more expensive but are faster to arrive. You should figure approximately 3 – 5 days’ lead time.

What is an EIN Number? Do I need one?

As a foreign importer, you do not need an EIN number for Customs Import purposes. You may need one as a seller on Amazon for State Tax purposes. Please check with Amazon and/or the Internal Revenue Service (IRS). You will be assigned an Importer Number by customs which will be used in lieu of an EIN Number for the purpose of the Customs declaration. You can be an importer without an EIN#. Customs will assign to you an Importer Number.

But you still need a Customs Broker and an Ultimate Consignee with an EIN#. If you use our FBA Prep Services, we will act as your Ultimate Consignee.

If you are U.S. based and are intending to import under a Corporation, then your EIN number will serve as your Importer Number. If you are U.S. based and are intending to import as a Sole Proprietor (e.g. John Doe dba ABC Importers), then your Social Security Number will be your Importer Number. If you are U.S. based and are intending to import as an Individual (e.g. John Allen Doe), then your Social Security Number will be your Importer Number.

What is a Customs Bond and what is the cost?

Customs requires that a bond be posted with every ISF and Customs Entry to ensure that all duties, taxes and fees owed to the federal government will be paid. An Annual Continuous Bond can be purchased for $500 and it will cover both your ISF filings and Customs Entries. Having a Continuous Bond also reduces our ISF filing fee by $25. If you choose not to purchase a Continuous Bond, you have the option of purchasing Single Entry Bonds for ISF filings and Customs entries. This can become quite costly especially if your shipment value is high or is subject to other government regulations such as FDA. Furthermore, the bonding companies only allow a maximum of “5” Single Entry Bonds for ISF before the importer is required to purchase a Continuous Bond. You would be saving money in the long run. However, if you are planning to import only once, then a Single Entry Bond might be for you. Single Entry Bonds are subject to a $25 Bond Processing Fee. Our Bond costs are below:

- ISF Bond: $75

- Customs Single Entry Bond: $6.50 per $1000 of the shipment’s declared value + duties/taxes (minimum charge of $65). For OGA (other government agency – i.e. FDA, USDA) regulated commodities, the rate is $6.50 per $3000 of the shipment’s declared value + duties/taxes.

- Customs Annual Bond: $500

What happens after I place an order with my supplier?

The process will depend on the terms of sale between you and your supplier. But the following steps are what typically occur for Regular Air and Ocean shipments. The below excludes shipments sent by Air Express Courier.

- Production begins (seller might send you a sample for approval)

- Determine if you will be using the services of an inspection intermediary service such as FBA Inspection or Earth Class Mail

- Seller arranges the International Freight Forwarding if his cost includes this (CIF terms); if his cost does not include this, then you are responsible for arranging and paying for the freight.

- Your supplier may have a couple of shipping companies to refer you to or you can obtain a quote from Rakuten Super Logistics. If the latter, seller will provide you with the cargo details which you will pass onto the forwarder giving you the quote. You will also want to include the U.S. destination address – whether it’s Amazon FBA or the Intermediary Inspection service of your choice.

- Hire a Customs Broker if separate from the Freight Forwarder.

- Get ISF details to Customs Broker (ocean shipments only)

- Shipment departs

- Send copies of all shipping documents to Customs Broker

- Shipment arrives

- Customs clears

- Our invoice is paid

- Shipment is delivered or dispatched

It is your responsibility as an Amazon Seller and Importer to know Amazon’s FBA requirements.

What is Importer Security Filing (ISF)?

There are 10 key elements about a shipment that must be transmitted to Customs at least 24 hours prior to the vessel’s departure from origin through Importer Security Filing (ISF). This filing provides information to Customs regarding the impending import shipment. Your Customs Broker is the most ideal party to handle this transaction. If the filing is late, misfiled or not filed at all, then the importer will be penalized a minimum of $5,000 (max $10,000). Customs requires that all ocean import shipments have an ISF filing whether or not it is late. Otherwise, your shipment will not clear Customs. A late filing or non-filing of ISF also guarantees that Customs will examine your shipment.

[thrive_leads id=’51377′]

What is a Harmonized Tariff Code (HTS)?

The Harmonized Commodity Description and Coding System (HS) is the mechanism by which international tariffs are standardized. If you ship items overseas, you are required to classify them according to the harmonized system. Each country has its own Harmonized Tariff Schedule (HTS).

The description and coding system of global tariffs is an internationally standardized system of names and numbers for classifying products. The first 6 digits of any HTS Code is (in theory) the same for any country. Beyond the six-digit level, individual countries sometimes have different rules for classification. Importers and Exporters the world over must classify all goods moved across international borders using the Harmonized System of the country of import. Every item you sell must be assigned an HTS Code according to the Customs tariff schedule of the country from which you are selling. Each HTS Code has an applicable duty rate. HTS Codes are sometimes referred to as HS Codes and Tariff Codes.

What is the time length for my shipment to be cleared by Customs?

We must allow Customs at least 48-72 hours to clear a shipment, although it could be less.

Why did Customs put a hold on my shipment? I have never had a problem with my DHL/UPS/FEDEX shipment before.

Please bear in mind that Air Express Shipments are treated differently by Customs. They simply move too many parcels on a daily basis for Customs to be able to monitor each one. And because Customs allows Air Express Couriers to clear an entire manifest under their own name and bond, it’s possible that your previous shipment may have just flown under the radar.

With regular Air and Ocean cargo, there is always the possibility of a Customs Exam which may cause a 3- 5 days delay in release. Any exam related charges will be the responsibility of the Importer of Record. Customs exams are generally random unless they have had a recurring problem with the manufacturer, the importer, and/or the commodity. That said, please ensure your product and its labeling comply with Customs laws prior to shipping.

What information do I need to provide to obtain a quote?

For a Customs Brokerage Quote:

- A full description of the item(s) you are intending to import – i.e. General Description/Name of Product, Function, Material/Composition, Declared Value, Unit Value, & Country of Origin.

For a Freight/Shipping Quote:

- Terms of Sale (i.e. FOB or Ex-Works)

- Address of your Supplier

- Port of Loading

- Number of cartons

- Dimensions of each carton

- Weight of each carton

- First U.S. Delivery address

For Amazon FBA Prepping Services Quote:

- Total Number of Cartons and Units

- A detailed scope of the services you require – i.e. Check for product and package damage, Apply FNSKU labels, Bundle, Insert Cards, etc.

What other fees should I expect?

If you using the International Freight Forwarding Services of another company, then you can expect charges due to their U.S. agent. Your shipment will not be released from custody until those charges are paid. Rakuten Super Logistics can pay those charges on your behalf for a fee of 1.5% and include them on our final invoice. Other fees may include Customs Exam and related costs and Storage/Demurrage Fees.

Who should be listed as the Notify Party, Consignee, Ship To?

If we (Rakuten Super Logistics) are hired as your Customs Broker, we should always be listed as the Notify Party.

If you are a U.S. based importer, the Consignee’s name and address will be your information. The Ship-to party will depend on who will be receiving your shipment immediately upon release from Customs.

If you are a foreign importer, the Consignee and Ship-to parties will depend on who will be receiving your shipment immediately upon release from Customs.

My supplier is asking for Shipping Marks. What are Shipping Marks?

Shipping Marks are printed on the outside of each Master Carton of your shipment. They should contain the information that will identify your cartons from cargo belonging to others. The suggested marks would be:

- Your Company Name

- Carton Count – e.g. Carton 1 of 10, Carton 2 of 10, etc.

- General Description of item

- Country of Origin

- Any special handling instructions – e.g. This side up, Handle with Care, Fragile, etc.

What shipping documents do I need to provide to Rakuten Super Logistics (or other 3PL)?

- ISF Details (for Ocean shipments only; we must receive this at least 72 hours prior to the vessel’s departure from origin)

- Ocean Bill of Lading or Air Waybill

- Commercial Invoice

- Packing List

- The above documents are obtained from your supplier. If you use our Int’l Freight Forwarding services, then our overseas agent will supply us with the ISF details and the Ocean Bill of Lading.

When do I pay Rakuten Super Logistics (or other 3PL) and what type of payment is accepted?

Payment for an Annual Customs Bond will be due upon receipt. Payment for Customs Brokerage services including duties/taxes, delivery, freight, etc. will not be due until your shipment has cleared from Customs and is ready to be delivered or dispatched.

We accept the following payments:

- Credit Card (Visa, MasterCard, American Express)*

- Wire Transfer**

- PayPal*

*subject to a processing fee

2) USING A COURIER SERVICE LIKE DHL, UPS, FEDEX ETC. (EIN RECOMMENDED)

Air Express Courier shipments sent via FEDEX – my recommendation, DHL or UPS are different. Customs has special regulations for them where they are allowed to clear entire mass quantities of shipments under their own name and Customs bond. They simply move too many parcels for Customs to be able to clear every single one. Therefore, they are authorised to clear shipments that are on one cargo manifest of low-risk up to values of their own discretion. They also won’t ask you to apply for a customs bond or filling an ISF. They provide a one-stop solution and are therefore more expensive than forwarding or logistics companies/customs brokers.

You simply be the Importer of Record with your foreign address or you can subscribe to services like http://www.usamail1.com/ to get an US address (not obligatory) and apply for an EIN here (obligatory if you want to be the ultimate consignee): https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/How-to-Apply-for-an-EIN

3) USING A PREPPING AND FORWARDING COMPANY THAT ACTS AS THE ULTIMATE CONSIGNEE (NO EIN NEEDED)

There are several services around that receive your goods (where you act as the Importer of Record) after cleared by customs. For example if you send in your order by courier (FedEx etc.) and then want them prepped, labeled etc. you can use prepping companies that can also act as your ultimate consignee. These guys are similar like the first example but usually don’t clear customs for you. You can act as the Importer of Record with a foreign address and will be assigned an Importer Number by customs. Once the prepping, labeling etc. is done these service provides will send in the order for you to Amazon.

4) USING A FORWARDING COMPANY/CUSTOMS BROKER AND ACTING AS THE IMPORTER OF RECORD YOURSELF (AMAZON’S EIN NEEDED)

If you send items by Air or Sea the regular way (meaning no courier like FedEx, DHL, UPS etc.) you will need a forwarding or also referred to as Third party logistics company (3PL) that can act as both the forwarder as well as the customs broker HOWEVER not as the ultimate consignee.

In this case you will be the Importer of Record and Amazon will be the Ultimate consignee. You don’t need an address or bank account in the US but you will need an EIN number of the ultimate consignee or Importer of Record. You can contact Amazon for this information but your Customs Broker should be able to obtain this information for you.

I also heard that sometimes Amazon refuses your goods if you don’t provide your own EIN but I haven’t found anything to the contrary.

You simply be the Importer of Record with your foreign address or you can subscribe to services like http://www.usamail1.com/ to get an US address (not obligatory) and apply for an EIN here (obligatory if you want to be the ultimate consignee): https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/How-to-Apply-for-an-EIN

There’s one more option. If you know someone in the US who is willing to receive your order as the Importer of Record providing his EIN number you can go that way too. But I recommend you pay all fees upfront so your friend/acquaintance doesn’t have to bear them.

Miscellaneous:

I do recommend you to apply for an EIN for general tax reasons and to comply with IRS regulations. Amazon can track your sales tax back with you and your country of origin.

If you want to learn more about the process and import from China professionally please check out our ImportDojo Masterclass here:

https://importdojo.com/importdojo-masterclass/