Welcome to the ultimate guide on starting an ecommerce business and build a brand. These days it is more important than ever to have a brand, a community, customers and social media channels. It simply isn’t enough any more to run Amazon PPC or Google/Facebook ads. To succeed on Amazon, you need to have:

● A good product

● A strong brand

● Multiple sales channels

Over the past few months, I have explored different strategies which will help you not only become a successful Amazon seller, but also gain exposure globally.

Aim For Long Term Success: Building a Strong Brand with Multiple & Global Sales Channels

The main aim of this post is to go from idea to a strong, recognizable brand in your niche. Unfortunately, a lot of entrepreneurs are focusing solely on the Amazon platform. While it may be the easiest and the lowest barrier to entry; there are many disadvantages:

● No control over your brand since the customer belongs to Amazon

● Amazon has made several changes which affected sellers badly

● Building a business on one income stream is never good

● Higher competition & lower pricing

● Some markets are saturated

In this post I will go over other E-commerce platforms, both in the US and in other countries. This post will provide an in-depth guide on which channels work best, including marketing strategies for each, including:

1. Which E-Commerce platform to use to build your own online store

2. Expanding in the US beyond Amazon, this will include stores such as Walmart and also small retailers(How to find them & approach them)

3. Selling in Japan & EU

4. Product branding – How to custom packaging, handling customer service & inserts

5. Social Media Marketing – A deep look into Adwords & Facebook advertising for e-commerce

6. Outsourcing & Building a Team – Where to find Virtual Assistants and which tasks make sense to outsource.

This is only a fraction of what will be included in this post. Please note this post has over 8500 words (hence the ultimate guide) so I will separate into 2 posts. Below is a brief overview of this ultimate guide:

Disclaimer: Some of the products may contain an affiliate link and we may make a commission if you click on it at no additional costs to you.

BRAND BUILDING ESSENTIALS CHECKLIST

Brand Building Essentials Checklist – The phrase “Build a Brand” gets thrown around often and most people know that having a brand is essential, by implementing these features, you are guaranteed to have a good foundation to build a global brand.

Before I get into this part wanted to give you an overview of whats coming and what the main milestones are in this series. Some of those topics are super exciting so make sure to share this blog post and stay with us until the end of the project.

Building a Brand

- The importance of building an Ecommerce brand

- Choosing a brand name & why it’s crucial for long term success

- Creating a Logo

- Choosing a slogan that fits the brand

- Creating a story behind your brand

- Brand Design 101: Brand colours, fonts & mood/voice. Consistency is key.

Business Incorporation

- Why incorporating is essential for your business )

- Where to incorporate. Pros and cons of each + which one is better for e-commerce.

- Currency accounts / Comparison of each & why it’s essential to not lose money in exchange rates.

Choosing a Product

- Product Research Guide

- Industry Research & Demographics

- Competition Analysis

- Identifying flaws in competitor’s products & making your product better.

- Private Label vs Own Design and why being unique is better.

Manufacturing

- Complete Guide on Manufacturing Overseas

- Certification

- Materials & components to avoid when starting

- Contracts – Protecting your brand

- Choosing a supplier

- Ordering samples & how to test each sample effectively

- Product Design Guide

- Mould Process Guide

E-Commerce

- Why having your own website from day 1 is essential for your brand

- A look at Ecommerce platforms & what do they offer. Which one we recommend for beginners.

- Building you store

- Email Marketing & Building a List

- E-commerce SEO and how to drive traffic

- PPC Overview

- E-commerce blogging

- Why good product descriptions is key to success

Social Media Marketing

- Setting up Social Media

- Gaining Exposure

- Social Media Marketing

- Connecting with Authority in your niche

Inventory Storage

- Fulfillment Centres – What they are and why they are essential for your growth

- List of fulfillment centres

- Fulfillment centres vs FBA

Branding your Product

- Product Photography

- Custom Packaging – standing out from your competition

- Shipping Boxes

- Insert Cards & Marketing Materials

- Customer Service & Experience

AMAZON

- A guide on using sellers central platform effectively.

- Amazon Sponsored Products – A guide to PPC and how to optimize your listing based on Amazon ppc Results

- Customer Service – How to handle different customer issues and respond effectively.

- Amazon Deal Guide – Lightning Deals – Prime Day – Black Friday Deals. How to apply and maximising profits during deals. We will also explore how to run deals outside of Amazon to your listing.

- Amazon Vine and Giveaway Program – An explanation and overview if it’s effective for your business.

Retail & Wholesaling

- Finding retailers & distributors in your niche

- Create a catalogue

- Contacting retailers

Going Forward

- Expanding to other countries

- Maximising other sales channels

- Creating a product line

- Exhibitions & Tradeshows

- Outsourcing

BUILDING A BRAND -CHOOSING A BRAND NAME

This will be the main feature besides the logo of your brand, so it must be chosen carefully. Brand Names can be mainly classified into 3 main categories:

1. Niche Specific – Example: Joe’s Tea Company

This choice is fine if you’re planning to exclusively sell within one specific niche or main category. However, as your company grows, it is essential to expand into different areas of one category.

2. Category Specific – Example: Joe’s Beverage

This option is ideal if your main focus right from the start is to grow your brand to dominate your niche. By not limiting the choice of products in the brand name you can diversify according to the market at that time. Targeting multiple sub-categories within a niche is essential(as we will learn later on in the series) because you can target multiple keywords within that niche.

3. Unique Brand Name – Example: Empower Drinks

This gives you the most freedom for your brand, as you can expand and release products without being limited by the brand itself. However, a lot of effort must be made to get the name out there and customers won’t start associating your brand with a specific category in the short term. The best benefit of a unique brand name is that you have complete control, this is especially true if trademarks, domain names and other intellectual property is available for you to register.

Ultimately, a brand name goes down to preference. All three choices require effort, a line of successful products and excellent customer service to succeed.

Logo Design

The logo, in most cases, IS what makes the brand. It is the key feature with which your customers will identify your brand. Before hiring a designer for your logo, here are some key aspects your logo should include:

Simple but Detailed

A logo shouldn’t be too complicated as it can be distracting, especially when it comes to products. Think of the products you will release, or plan to release on the market, it is likely your products will be made of different materials(wood, stainless steel, fabric, etc.) and a variety of methods of application(embroidery, engraving, stamping, etc.). A great logo will make your products stand out more and its a great way to start building a brand.

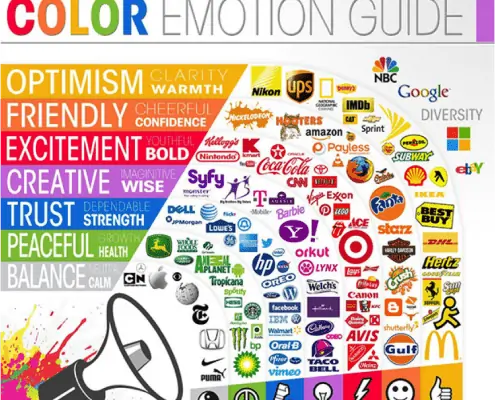

Colour Scheme

Ideally your brand shouldn’t have more than 2 or 3 colours in all of it’s branding. This applies to all aspects of the brand. In the pictures below, you can see how all the major brands pick one main colour and focus all their branding on it.

DEMOGRAPHICS

Make your brand appealing to the audience you’re targeting. Audience segmentation will be helpful in targeting the right demographics that may be interested in your brand through advertising and social media. The main demographics you should be interested in are:

1. Gender: Male or Female

2. Age Range

3. Location – Country and State/Province

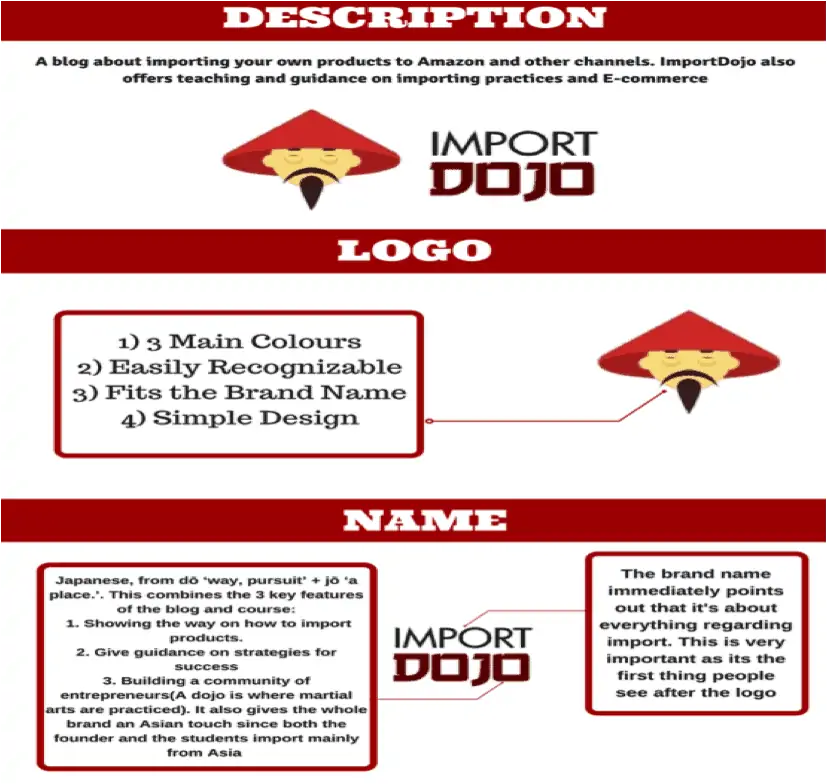

How ImportDojo Applies Branding

As you can see from the image above, Import Dojo implements all key elements when it comes to branding. The brand name in itself has great relevance to its audience. The logo is fairly simple and recognizable, with few, but bright colours.

However, what makes the brand in this case, is the story of how Import Dojo was started and why Manuel had the idea to start the blog. You can read more about it here.

Products, even if essential, are only one aspect of the brand. When you combine the same concepts throughout your website, social media and packaging; that’s when a brand truly starts to distinguish itself from the competition.

The Hard Truth: Branding Takes a Long Time To Be Effective

Unfortunately, the not so sexy part about branding is that it takes an unbelievable amount of work, consistency and time to see the rewards. Nonetheless, people are more likely to buy from a company that offers a unique experience to its customers. The whole point of this post is expand your brand to multiple sales channels and expand globally.

While Amazon will still be the main sales channel, having control over your brand, customers and products is going to be the only way to succeed in the future.

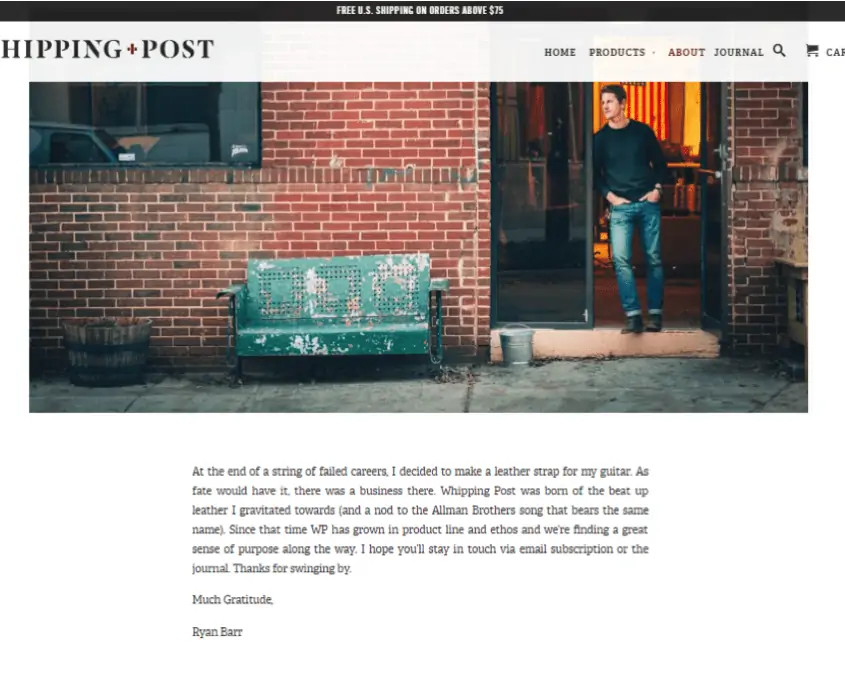

BRAND STORY

With lots of brands coming up everyday, it’s essential to differentiate your brand from others – especially if you want to expand further than Amazon. Having a story or a purpose for your brand will help you connect with customers and gives a human touch to the company.

Before coming up with a story, ask some key questions:

- Who is my target market? (Age, Income Levels, Gender)

- Why am I selling this/these products?

- What problem/need I want to solve?

- Why did I start this brand/company?

These will all help you come up with a good story that you can use both in your products and marketing materials. One of the most viewed pages on a company’s website is the About Us page -customers / viewers want to know who they’re purchasing from.

They are more willing to purchase from a company they can connect with. This will be the foundation of building a customer base off your site and be different.

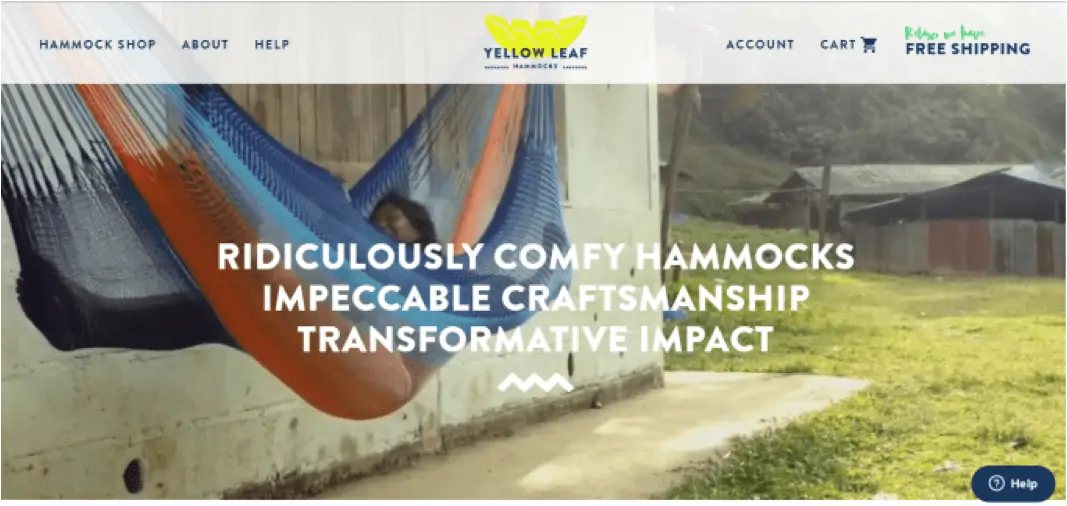

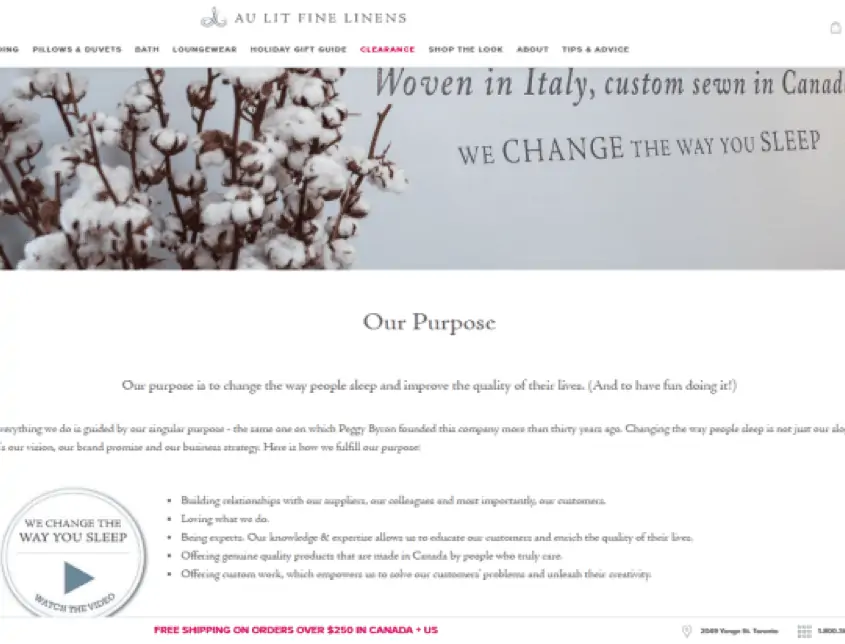

Here are some examples of how some brands applied their stories into their whole company profile:

Yellow Leaf Hammocks

CREATING A SLOGAN

Slogans are a key part to branding because they either:

- Tell viewers what your brand is about

- Deliver the brand/company message

This will be even more important if you choose to go the unique brand name route. While having a unique brand name has a lot of benefits, potential customers will have no clue what your brand is about, unless your Logo is related to the category/niche you’re selling. A good slogan has to be very short, memorable and unique.

A good place to start is Shopify’s Slogan Generator.

As you can see the program generated over 1,076. It’s important to choose a slogan that fits your brand and the products you will sell. Generators are good for brainstorming ideas and inspiration – using the slogans the generator give you is not recommended. However, you can pick a slogan that fits you and modify it as your own.

HIRING A DESIGNER

The final step is to put all these great ideas to mind and find a designer to put your brand to life.

Ideally, choose a designer which has the following attributes:

- A great portfolio

- Experience working with medium/large companies

- Experience in E-commerce design

- His/her experience is not limited to logos only. This is because you will need to apply the same branding throughout packaging, website design, inserts etc.

- Ideally has worked with clients in your same niche/category

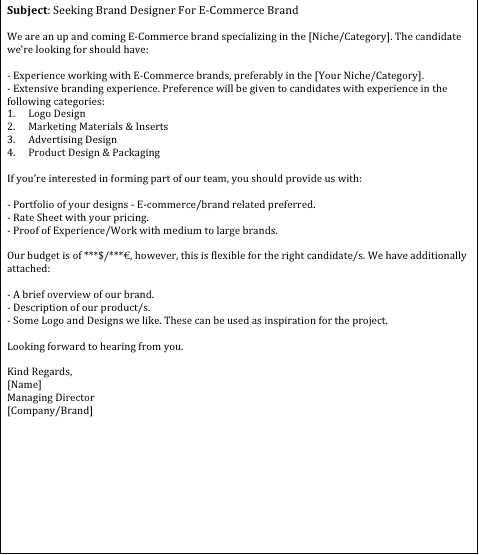

Here is an email/proposal template I use on freelance websites. I always try to give as much detail as possible. This helps me filter candidates who are truly interested/passionate.

Subject: Seeking Brand Designer For E-Commerce Brand

We are an up and coming E-Commerce brand specializing in the [Niche/Category]. The candidate we’re looking for should have:

– Experience working with E-Commerce brands, preferably in the [Your Niche/Category].

– Extensive branding experience. Preference will be given to candidates with experience in the following categories:

1. Logo Design

2. Marketing Materials & Inserts

3. Advertising Design

4. Product Design & Packaging

If you’re interested in forming part of our team, you should provide us with:

– Portfolio of your designs – E-commerce/brand related preferred.

– Rate Sheet with your pricing.

– Proof of Experience/Work with medium to large brands.

Our budget is of ***$/***€, however, this is flexible for the right candidate/s. We have additionally attached:

– A brief overview of our brand.

– Description of our product/s.

– Some Logo and Designs we like. These can be used as inspiration for the project.

Looking forward to hearing from you.

Kind Regards,

[Name]

Managing Director

[Company/Brand]

THE IMPORTANCE OF BUILDING A BRAND

With the effects of globalisation becoming stronger, more people are looking into creating new income streams, one of them is E-commerce. This is especially true in emerging economies where people are exploring different ways of making money. Competition is at an all time high as more new sellers from different nations and income levels are diving into E-commerce & online selling.

Having a good product will come first, however, repeat customers and word of mouth is priceless for long term success & growth. This is happening more often on large E-commerce sites like Amazon, where private label sellers have similar products targeting the same audience. The only way for a customer to issue a purchase is:

-Price

-Reviews

-Listing

-Photography

This becomes complicated when most of the products have the same design. In fact, at the slightest change from Amazon, they lose sales since there is no control. The only way moving forward is to build a brand both on and off Amazon, expand globally & build a trusting customer base

BRAND BUILDING – BUSINESS INCORPORATION 101

Now that we have covered part 1 of this post (building a brand essentials) let’s get into the next part, legally setting up a company, banking and more.

How to set up business banking – Over the past few weeks we went over the basics of building a brand. One thing all major(and minor) brands have in common, is that they are protected from a legal perspective. Having a good business structure will give a lot of benefits moving forward. Although the initial set up process can seem overwhelming and expensive, it doesn’t have to be. Nowadays, there are many countries where you can incorporate remotely that provide a lot features, benefits and most importantly in a financially secure jurisdiction.

In the next part of the series we will guide you through everything regarding business incorporation and banking – including some helpful tips on where to incorporate your business.

P.S. This guide is only meant as a resource. While a lot of research has gone into proving helpful and accurate information – We are not lawyers. Before incorporating your business, especially in countries outside of yours, always consult with a qualified professional specialized in international laws & taxation.

Why Incorporate?

Many new business owners and online sellers alike often ask if they should incorporate their business before selling online or do it once they are established and have capital. This all depends on what type of business you run, in our case, what products you’re importing. If you’re importing products of high-risk liability such as:

- Electronics or Electrical Appliances

- Toys & Baby products – and any products used by children ages 3-10

- Supplements

- Cosmetics & Beauty Products

- Food & Drinks

These are all products that need certifications and in some cases lab testing done. If you’re importing as a Private Label(and not an established brand), a corporate structure will offer you an extra layer of protection.

Furthermore, having your business incorporated has numerous advantages which are helpful especially later on when your business grows larger. Some of the benefits include:

Personal Asset Protection

It is very important early on to separate personal assets and business assets. Aside from the initial stage where you have to fund your business, you should immediately get a business account for your transaction. This is crucial not only because some banks won’t allow you to use your personal account for business, but more importantly, having your personal assets separate, will protect you in the unfortunate event your business is liable for damages.

A business corporate structure, such as a Limited Company, will protect your personal assets. This is the main reason what makes incorporation attractive.

Transferable Ownership

In the event of an exit, company shares or members can be transferred. Making it very easy and attractive if you want to sell your company in the future. This is true if you have a Corporation structure, where you own 51% or more of the company, shares can be easily sold or transferred to the new owner.

Tax Benefits

Depending on the structure and country of incorporation, you might find out that you owe less taxes than self-employed/sole proprietorship. This is due to numerous tax cuts and deductibles offered to business owners. If you qualify, your tax bill can be reduced greatly, as always, consult with a law firm specialized in business incorporation or your CPA on what tax cuts are available in your country or state.

Important: This shouldn’t be confused with tax evasion and it’s by no means condoned. Tax avoidance is allowed only in accordance with the tax laws of the country of incorporation. For this reason, if incorporating in a country different than the one you’re resident in, consult with the tax authorities before proceeding with incorporation.

Separate Credit Rating

Your company will have it’s own credit rating and it won’t be affected if your personal credit score is not good. Keeping a good credit score for you business will give you a lot of benefits, these include:

- Increased overdraft facilities

- Higher Credit Card Limits

- Bank Account Upgrades

- Dedicated Financial Advisor(depends on the bank and account history)

- Reduced or No Account Fees

Having a good history will make your company investor-friendly as investors or potential buyers want a company with few debts or liabilities.

RETIREMENT PLANS AND PAYROLL

Having your own company will allow you to create private retirement plans for you and your employees. Depending on the bank, business accounts have payroll management in their system. This will be very helpful if you plan on having employees or contractors.

Disadvantages of Incorporation

Unfortunately, while there are a lot of benefits to business incorporation, this comes with it cons. This is true to small business owners and people with limited capital. Some of the disadvantages are:

A Lot of Paperwork

Registering and maintaining a business comes with a ton of paperwork and filing. This can be very confusing if you’re new or if this is your first company. Each country has it’s own laws and if you’re selling globally, you have to comply with each country.

This can be quite overwhelming, but unfortunately it must be done. To make things easier, have your CPA or lawyer take care of your company filing – that way you have no risk of incurring fines.

Fees! Fees! Fees!

With tons of paperwork, comes tons of fees. Between registration fees, yearly licences, taxes and CPA fees; your outgoing expenses might increase. Maintaining a corporation can become expensive and shouldn’t be done without capital.

Limited companies are popular because the fees are lower and have less filing requirements than corporations. This is the structure that works best for new sellers and those in e-commerce in particular.

Liability Is Not Guaranteed

While incorporating your business may protect your personal assets, you may still be liable in some cases. Only a Corporation fully protects the personal assets of the shareholders. If you import products with high-liability, it’s best to consult with a lawyer on which structure is suitable.

[thrive_leads id=’51377′]

USA INCORPORATION

There is a common misconception amongst people outside the USA that incorporating your business in the US is expensive and complicated. Furthermore, in some cases, if you’re importing in the US, you need to have a US company or subsidiary. Some dropshippers in the US will also refuse to work with you unless you have:

- Reseller Licence

- Employer Identification Number

US LLC State Registration

It is recommended to start off with an LLC if you choose to incorporate. For US non-residents the 3 best states to incorporate are:

Delaware

Delaware State is the most popular place for foreigners who wish to incorporate in the US. However, Delaware is better suited for those wishing to form either an S-Corp or C-Corp.

- State Filing Fee: $200

- Certificate of Formation: $90

- Annual Fees: $300 Alternative Entity Tax by June 1 + State Filing Fees $200 = $500

Nevada

Home to the popular Las Vegas, Nevada is one of the best states to file an LLC, with it’s very attractive tax rates and ease of filing. Besides the yearly fees, there are no other requirements to follow.

State Filing Fee: $75

Annual Fees: Business Licence $200 + Annual List $150 = $350

Wyoming

Wyoming is the cheapest state of the 3 for LLC costs. It offers all the benefits of states like Nevada and formation shouldn’t take longer than a few business days. Foreigners wishing to incorporate in Wyoming, must have a registered agent notifying the state in writing.

- State Filing Fee: $100

- Annual Fees: $100

In all three states you require a Registered Agent. A registered agent is a person or service that acts on your behalf in the state of incorporation. They would receive any letters/paperwork and notify you when paperwork and annual fees are due. Services normally start at around 49$/year and it’s required by law to have a representative in the state of incorporation.

Employer Identification Number

The EIN, is the tax identification for your business. This will be the number used to conduct business inside the US and for importing/exporting goods.

If you’re a US resident or you’re a non-resident, wishing to get an EIN, the process is quite simple, and you can either get the EIN by applying online, phone or by mail. If you’re a US non-resident with a US LLC/Corporation, you will need a responsible party to get the EIN.

To get the EIN you need to fill out Form SS4 and send it to the IRS. Getting an EIN is very simple and fast – the whole process shouldn’t take more than 15-30 minutes and is free of charge.

Getting a Bank Account

If you’re not a US resident, this is the biggest issue you will face. It is extremely difficult and rare to get a US bank account(business or personal) without being physically present. In some cases, there are companies that offer the service of opening a bank account remotely, however, they are expensive. You can also consult with your CPA or lawyer and see if they can open an account for you.

To open a business account in the US, you need:

- Passport

- EIN & Company Registration Documents

- Business Licence

- Articles of Organization – This is a list of all the members in the company, you should get the documents when you register the company.

- Operation Agreement

Keep in mind that every bank is different and requires different documentation. If you’re a non-resident, inquire beforehand on what documents are needed.

Virtual Address

You need an official business address, this is needed to receive company mail and to register for services & marketplaces. A virtual address will notify, forward and even scan your mail – There are numerous companies offering these services for as little as $90/year.

Phone Number

If you’re registering a US LLC as a United States Non-Resident, you need a US phone number. This is will be required by all businesses(including banks) and marketplaces you will deal with.

The easiest and best option is to simply get a Skype number, it is fairly cheap with low call rates. If you’re based in the US, it is recommended to get a business phone number.

OTHER INCORPORATION COUNTRIES

Let’s also explore some of the best countries where to incorporate.

P.S. This guide is only meant as a resource. While a lot of research has gone into proving helpful and accurate information – We are not lawyers. Before incorporating your business, especially in countries outside of yours, always consult with a qualified professional specialized in international laws & taxation.

The Ultimate Double Taxation Guide

Most E-commerce sellers come from a wide range of countries and sell in a wide range of markets. The most common ones are:

- US residents selling in the US, EU & Asia

- Europeans selling in the EU & USA

- Individuals who either come from other parts of the world and sell in the US/EU

- US/European residents who sell in other markets & countries outside Amazon

Most sellers normally pick one market, for example, the US, and start selling there. This is easy because when it comes to tax, you have to deal with:

- US Taxation(sales tax, customs, import duties etc.)

- Personal Income Tax based on your country of residence

Naturally, as you your business grows, you need to expand into other markets. This is where things get complicated as each country has it’s own tax laws & systems. In particular, when it comes to international tax, double taxation comes into effect.

What is Double Taxation?

Double Taxation is commonly referred to when income taxes are paid TWICE on the same source of income. It normally occurs when income is taxed at both at personal and corporate levels. There are two types of Double Taxation:

1. Juridical

This is when one source of income is taxed by two or more countries. For example, you’re a German resident who sells goods on Amazon US and you get taxed by both US and German authorities on the same income.

2. Economic

This happens when more than one person is taxed on the same income. This often happens when a company has multiple members/shareholders and the same income is taxed on that income(instead of redistributed amongst each member and personal tax is paid).

Important

Double Taxation is often a unintended consequence of international tax legislations. Countries and tax authorities try to avoid double taxation as much as possible and systems are in place to avoid you or your company paying twice on the same income.

International Double Taxation

International businesses are often faced with issues of double taxation. Income may be taxed in the country where it is earned, and then taxed again when it is repatriated in the business’ home country. In some cases, the total tax rate is so high, it makes international business too expensive to pursue.

To avoid these issues, countries around the world have signed hundreds of treaties for the avoidance of double taxation, often based on models provided by the Organization for Economic Cooperation and Development (OECD). In these treaties, signatory nations agree to limit their taxation of international business in an effort to augment trade between the two countries and avoid double taxation.

What is a Double Tax Treaty? Does my country have one?

Many countries around the world have signed agreements or treaties between them as a means to avoid double taxation. These are based on models provided by the Organisation for Economic Cooperation and Development(OECD). This is a life-saver for business owners as they often have issues of the income being taxed in the country where it is earned and then taxed once again once it’s moved to the owner/s home country(or residence).

To find out if your country of tax residency has a double taxation treaty with the country you do business in, check on both countries tax authority website. You can also search on Google by typing: “Country” + “ Double Tax Treaty” – replace the country field with the country you do business in(example: USA).

How can I avoid Double Taxation?

To avoid double taxation, there are two ways:

1. Speak with your accountant/CPA so they file for taxes correctly on your behalf.

2. Have a limited liability company(or the equivalent) – Limited companies have the ability to pass on their profits to their owners and pay personal income tax on the earnings.

The Advantage of Having a US LLC

Having a limited liability company in the US has a lot of benefits. However, perhaps the biggest benefit of all is the ability to make the LLC a disregarded entity. This means that any profits the LLC makes, get passed onto the member/s – so basically the LLC in itself never gets taxed, only it’s owners. This is perfect for those who are non-US residents and are part of a double taxation treaty with the US, as you can get taxed on your personal income in your tax residency.

Keep in mind that you still have to file a tax return with the IRS at the end of each financial tax year(normally April). This is a great benefit and when you form your LLC, is something you should definitely discuss with your CPA.

Tax regulations can be very confusing, unless you have experience in handling taxes on your own, always consult your CPA, accountant or tax authorities first. Double taxation can be avoided if there is a structure in place.

In the event you’re taxed twice on the same income, this can always be refunded back. However, it’s a long and bureaucratic process which can greatly reduce your cash flow and delays to your business.

Other Limited companies in other countries have the same structures as a US LLC, so make sure you’re aware of the tax laws before incorporating in a jurisdiction where there is no Double Taxation Treaty!

OFFSHORE INCORPORATIONS

There is a common misconception surrounding foreign incorporations being labelled as tax havens. This is all depends on where you incorporate and how you declare tax – I would always recommend declaring your offshore company with the tax authorities back home. A good idea is to incorporate either:

- Where the majority of your business operations will be

- The country of residency

- Countries which have a very good legal, banking, and taxation systems – such as Singapore and Hong Kong.

- Let’s look at some of the best offshore incorporation structures and what they offer.

British Virgin Islands(BVI)

Warning: BVI has been recently in the news due to tax evasion. Currently, these jurisdictions are at a greater scrutiny from tax authorities in the US and Europe. Should you still want to incorporate here, consult with the tax authorities back home and make sure you declare your registered offshore companies to comply with the law.

Other jurisdictions under the public eye are Bahamas, Panama & Barbados.

The BVI are an idyllic paradise islands located in the Caribbean Islands known for it’s super-rich expat community & low tax rates. Here is a complete overview of BVI incorporation:

Main Features

- Company documents are widely accepted by major international banks.

- Fairly low yearly renewal fees.

- Information about the owners, directors and shareholders is not public.

- No property purchase restrictions in the BVI & freedom of doing business in any country.

- Anyone can register a company in the BVI

- Companies incorporated in other jurisdictions can be moved in the BVI

Requirements

- Must have a registered address inside the BVI, main address can be in any country. For this, you can easily use an agent or law firm to act as a registered agent.

- Minimum member requirements are 1 shareholder and 1 director.

Capital

BVI companies have to issue a minimum amount of shares on their behalf. The maximum authorized capital for 50,000 shares($1 value for each share) is subject to a government fee of $350.

Tax Rates

BVI companies pay zero tax for all it’s members, directors, officers & shareholders. This is what makes the BVI an attractive option.

Annual Fees

Each BVI company must pay the annual renewal fee of around $800 – 1000$. The fee mostly depends if you’re filing for renewal on your own or using a service.

Public Records

Names of the directors, officers and shareholders are not filed with the BVI Register of Companies, not included in the Memorandum and Articles of Incorporation and not available for the public.

There are no accounting and audit requirements for BVI companies.

Time-frames of Incorporation

5 to 8 business day from making the Apostille & documents. Most third-party incorporation services can register you in 1-2 business days upon receiving all documentation.

Overall Costs

$1200 Incorporation Fees & $800-$1000 yearly renewal. This doesn’t include any share capital for the company.

ESTONIAN E-RESIDENCY

The Estonian E-residency program is not quite an incorporation – However, it’s specifically designed to act as a digital identity. This is perfect for location independent entrepreneur who need a “base” in a European country. The E-residency is not a residency program, however, you can register an Estonian company which is also very attractive.

Features

- Digitally sign documents and contracts.

- Document verification and encryption

- Form an Estonian company online. You need an Estonian address & bank account(which you have to fly in Estonia to open).

- Merchant Accounts available

- Tax Filing can be done online. However, tax residency must be established first.

- In addition to this, people who enroll in the e-residency scheme will receive a smart ID which provides:

- Document encryption & authentication

- Digital signing of documents

- Digital Identification

This scheme is truly unique as it provides a way to shift taxes & documentation entirely online. As more people are working from home or becoming digital nomads, having an online ID which provide top security features is a must. The E-residency only costs around €100 and the process is done entirely online.

SINGAPORE

Singapore is perhaps one of the best places to incorporate since it’s very entrepreneur-friendly and a strong financial centre of Asia and worldwide. The main attractive thing about Singapore is that it’s own government pushes for new entrepreneur to register their companies there. This makes the process more streamlined and you get a lot of help. The government website also provides a lot of information.

A limited company in Singapore is called a Private Limited Company and each registered company must bear the suffix Pte Ltd in all official documentation.

Features and Benefits

- The Pte Ltd is a separate legal entity in Singapore. This means that the company liabilities are completely separate from it’s members and shareholders(ie You)

- Singapore’s Pte Ltd. outlives the lives of its shareholders. Meaning the company stays active even if the owners pass away.

- Registering a company in Singapore will give you a credible image and makes it attractive for business and investors.

- When registering the company you have the option to pass the company to a new ownership if the need arises. This is a great feature as you can easily pass company ownership to investors and buyers in the event of an exit.

- The first 300,000 SGD earned are eligible to a government tax credit of 50-100%, for incomes over 300k SGD, the corporate tax rate is 17%.

- If the profit is already taxed on an income level, the Singapore PTE Ltd. Frees you from any capital gains.

- If you’re not a resident of Singapore(ie a foreigner), you MUST appoint at least 1 local director – which can be either a Singaporean/a citizen or PR. However, if you want to shift operations to Singapore, you can obtain an EntrePass visa – Singapore’s employment pass.

Registration Process and Requirements

- The entrepreneur must choose a unique business name for the business, preferably with an available domain name. A name check can be done and reserved also.

- A Singapore Limited Company can have a minimum share value of 1 SGD, there is no maximum capital share value. The company can have a maximum of 50 shareholders.

- Company must have a real address in Singapore and the local person appointed as director must be 18 years or older.

- You must appoint a local secretary no later than 6 months from the date of formation.

- Some private limited companies will require enlisting auditory services. This can be checked before applying for registration.

- Some sectors of the economy require government approval before incorporating. Some of these sectors are finance, banking and insurance.

- If you’re planning to set up the Singapore Limited Company as an offshore company, you must use a third-party service to file the application process. Foreigners are not allowed to file for registration for there own. Singapore has a visa-free policy of up to 90 days for most nationalities and you don’t need any special permits to form the company.

HONG KONG COMPANY

Hong Kong is where I have incorporated myself and I find it the best option for an eCommerce seller.

Hong Kong has long been considered a financial Mecca of Asia and it’s actually the place I would recommend to register an offshore company. Their banking system is excellent and it’s a very entrepreneurial country. The process is getting a bit more difficult, however, with the proper guidance, the incorporation process is fairly straightforward.

The most common type of business entity registered in Hong Kong is a private limited liability company. Limited liability companies are a separate legal entity for its owners compared to structures such as sole proprietorship. Anyone above the age of 18 can set up a company in Hong Kong.

I will list all the process and requirements for registering a HK Limited Company. Due to the complexity of the process and tighter regulations, it is recommended you engage a professional firm to handle the process.

Requirements for HK Companies

Company name – The name must be unique and needs to be approved before proceeding with incorporation.

Directors – Unlike Singapore, directors can be from anywhere in the world. You must appoint at least 1 company director and there is no requirement for the director to be a nominee shareholder in the company. Directors must be of at least 18 years of age and board meetings can be held anywhere in the world.

Shareholders – HK Limited companies allow a minimum of 1 and a maximum of 50 shareholders. There is no residency requirement of the shareholders and a single individual can own 100% of the business. Nominee shareholders can also be appointed and shares can easily be redistributed and sold.

Company Secretary – The appointment of a company secretary is mandatory. The company secretary must be a resident in Hong Kong or have it’s official office/place of business in HK. The company secretary must be a different person in the case of a sole director or shareholder. The role of a company secretary is to maintain the company books and ensure compliance with the laws of Hong Kong.

Share Capital – The general norm is to have 1 share per owner, the currency of shares can be in any major currency and if transferring shares they are subject to a stamp duty.

Registered Address – To be able to register the company, you need to have a registered Hong Kong address. This must be an actual address and not a P.O. Box..

Public Information – Information about the company and it’s members is available to the public in compliance with Government laws. If you wish to keep details and names hidden, you can consult with a professional firm.

Taxation – Profits tax is set at 16.5% for profits made in Hong Kong. Only profits and income earned in Hong Kong are subject to the tax as HK has a territorial taxation policy – Meaning profits made outside Hong Kong aren’t subject to tax. There is no capital gains tax & withholding dividend taxation.

Compliance – It is mandatory for companies to maintain accounts. Accounts must be audited annually by a Certified Public Accountant in Hong Kong. Companies must also file an annual renewal fee and must hold an Annual General Meeting, 18 months from the date of formation. The subsequent years, the AGM must be held every 15 months.

Time-frame – It usually takes between 5 to 7 days to incorporate in Hong Kong.

NB: Although there is no official requirement to be physically present in Hong Kong, you must be present in order to get a Business Bank Account. It’s difficult(if not impossible) to get a bank account remotely.

Documents Required

To set up a company in Hong Kong, the following documents are required:

- Articles of Association of the company. A copy is normally provided by the firm assisting the incorporation process.

- Incorporation Form that includes all of the following:

- Company name

- Registered address

- Description of your business & sectors you will be operating in

- Personal Details of shareholders, directors and company secretary

- Member Liability

- Share capital – Amount & No. of shares

If directors or shareholders are non-residents of Hong Kong, these additional documents are needed:

- Copy of passport

- Overseas proof of address

- Bank Reference Letter

For resident shareholders and directors:

- Copy of Hong Kong identity card

- Proof of address

For corporate shareholders and directors who are registering a subsidiary in Hong Kong:

- Copy of parent company registration documents such as Certificate of Incorporation and Articles of Association

NB: If your documents are not in the English language, they must be professionally translated.

Further Assistance

If you need further guidance on the best policies of registering a Hong Kong Company, Michael Michelini from Global from Asia can possibly help you here.

I know this can be a really confusing topic, especially when starting out. This is one area(the others being taxes, accounting & IP) where you should seek out professional advice due to the complicated nature & international laws.

However, the aim of this (ultra-long) post is to guide you in the right direction and be protected from the legal aspect. The correct incorporation structure can have a lot of benefits for you and your business – whether it’s tax credits or legal protection of your personal assets. In the next section we will move over to business banking where we will explore some of the best accounts & practices to save you money.

BUSINESS BANKING

How to set up business banking – Having a good business structure is only one part of running the business – A good company needs to have the best tools to be financially viable. In this blog posts we will talk about business banking, transfers and international exchange rates. As your business grows, you can’t afford to lose money in fees, for this reason, it’s important to choose the best banking tools you can find.

Regardless of the country you choose to incorporate in, we suggest you have:

- Business bank account In the country of incorporation

- Bank account in you home country or country of residence

- International Bank Card(HSBC, Chase, Deutsche Bank etc)

- Currency Exchange Account

We recommend having accounts in all 3 major world currencies – US Dollar($), Euro(€) and Pound Sterling(£). You may ask why would you need so many accounts if you’re only operating in one country or currency?

There are 3 reasons:

1. Market Crashes & Recession

As we have experienced in the past, countries have market crashes or recessions which greatly devalue the local currency. This can sometimes be so severe to eliminate your profits or worse put you out of business. Having an second account in another currency will enable you to switch/move your assets and reduce the risks.

2. Global Expansion

At some point in your business, you will want to expand into other markets besides the US. Having an account in the local currency combined with a low exchange rate account; will save you fees on money transfers.

3. Material Prices & Sourcing

A lot of E-commerce sellers overlook this very important aspect, materials rise and fall according to the local(and global) stock market affecting labour costs – and increasing you Cost of Goods Sold. A good way to go around this issue is:

- Source different types of materials so your risk is spread out (Wood, Aluminium, Titanium, Textiles etc.)

- Source from different markets. Example: Electronics from China, Textiles from India and Merchandise from the USA

In every business there is risks involved, however, what separates successful businesses from unsuccessful ones is that they prepare their business for every situation.

Here are some of the best business accounts in the world you can use – there are no affiliate links and all the companies/banks mentioned are listed because they truly provide the best value and they are tools we use.

BEST GLOBAL BANKS

As we will mention in this blog post, nowadays, there are a lot of banking options. However, I would also recommend having a bank account with a major, global brand. While their fees may be higher, the fact that they have a global presence is perfect for E-commerce. HSBC is probably the best choice if available in your country since they offer:

- Free ATM withdrawals from HSBC ATMs worldwide.

- Insurance packages – Travel Insurance, product liability insurance, house insurance etc.

- Free Transfers to any HSBC account worldwide – If your supplier has an HSBC account, this will save you a lot of fees!

- Account opening assistance worldwide if you’re an HSBC customer

- Very good online banking & secure

Citibank is a great alternative to HSBC (if it isn’t available in your country). Their service is top-notch and their accounts come with a lot of benefits. The Citibank Plus Account in particular is a really good option, it’s features are:

- No monthly/yearly costs

- No ATM fees worldwide – However, they don’t refund ATM charges that local banks charge abroad.

- No foreign transaction fees

- No currency exchange mark-up – You get charged Visa’s official rate.

- No fees on international transfers

USA BANK ACCOUNTS

This is probably the best bank account in the US to have if you travel overseas a lot. Almost every service the bank offers is FREE – One amazing feature that is very rare in banks: they refund you worldwide ATM fees you get charged by the overseas banks. Their only downside is their online banking system, which is a bit lacking. However, having this account as part of your banking is definitely an asset.

You need to be a US resident or have a US address(if you’re not a US resident you can use a mail forwarding service). You can open an account online and they have a few branches across the country. If you’re not a US resident, we suggest to visit a branch to open the account.

Features

- No monthly fees

- No set-up fees

- No ATM fees – Worldwide

- No foreign transaction fees

- No currency exchange mark-ups – You only get charged Visa’s official rate

EUROPEAN BANKS

- Fee-Free in Europe(SEPA Countries)

- Low ATM fees Worldwide

- Very low transfer fees(if transferring within SEPA)

Norwich & Peterborough Building Society

- No debit card fees worldwide – including ATM withdrawals

- £5 monthly fee – Free if a balance of £5000 is kept in the account or deposits of £500 monthly

GERMANY

- Free – no set up costs & no monthly/yearly subscriptions(for the basic plan)

- No ATM fees worldwide – However, they don’t refund ATM fees the local banks charge(if using an ATM outside the EU).

- No foreign transaction fees

- No currency exchange markup

- Downside – Their English customer support is very limited. However, it’s a pretty good option for German residents.

SWEDEN

- No ATM fees worldwide

- Free SEPA transfers

- No currency exchange fees

- Monthly fee 25 SEK(~2.50€) – Waived for students and persons younger than 21 years old.

- Free Travel Insurance for trips up to 45 days

ONLINE ONLY BANKS

N26 is by far the best online bank in Europe! Based in Germany it is now available in all EU & SEPA countries except Malta & Cyprus. The bank offers three plans – N26, N26 Black & N26 Business. N26 is now a certified bank and they offer deposit protection up to €100,000 according to EU regulations.

Features

- Free – no set up costs & no monthly/yearly subscriptions(for the basic plan)

- No ATM fees worldwide – However, they don’t refund ATM fees the local banks charge(if using an ATM outside the EU).

- No foreign transaction fees

- No currency exchange markup – You only get charged Mastercard’s official rate.

- The entire account opening process is online — you never have to physically show up anywhere

- Card usage notifications directly from the app

- Free Mastercard

- Customer Service Support in German & English

- To be eligible for a N26 Account you need:

- EU resident/citizen – You need to submit proof to be eligible

- A mailing address in Germany – You can use a German virtual address for this.

This is by far the best online-only bank if you’re from the EU & travel a lot!

CURRENCY ACCOUNTS

If your exchange fees are eating up your profits, you will need a service that offers the following:

- Low Exchange Rates

- Ability to transfer large sums of money

- Experience in dealing with online sellers

- A platform that supports multiple currencies

WISE ticks all the above! The set up process is quite is easy – just fill out the form on their website and a representative will contact you to see what type of business you run. WISE offers:

- Extensive experience in dealing with online sellers – particularly Amazon

- Low Exchange Rates

- Risk Management – if you transfer huge sums of money, you want the best rate in real-time. This service will contact you when the exchange rate is ideal so you don’t loose money on extra fees.

- Supplier & Manufacturer Payment – This is what separates WISE from the rest. They cater to a specific need us importers want (ie paying suppliers)!

- Amazing customer service

I can’t stress enough how important having a good currency exchange account is. While Paypal is great to start with, their fees will eat your profits as you grow larger and payments become bigger.

This will also be true when you start to outsource different tasks of your business. It is likely that your employees/contractors/freelancers will be from different countries, having a currency account will allow you to streamline payments more effectively. I have personally used WISE since 2019 and I’ve saved thousands of $ along the way.

Pheew this post is getting really long. So I’ll seperate into two posts.

CONCLUSION PART 1

This post was meant to give an overview for the legal and financial aspect of this business. Although it can be quite overwhelming, having a proper legal business will greatly benefit you in the long term. Our goal with this post is to create Sell-able Brands, and a business that has a good legal structure and management, is more attractive to potential investors.

In the next part of this series, we will move over to Product Selection, but with a twist, many sellers are realizing that to succeed in Amazon & in other E-commerce platforms – products need to be unique and innovative. In the next few weeks, we will explore how you can improve existing top seller products and releasing products that customers’ in your category want. I will give you a complete guide on Product Design, Certifications, Patents & Manufacturing.