This is a guest post by Claire Taylor from SimplyVAT.com. I met her last month in Hong Kong & Shenzhen at conferences around selling online and AmazonFBA. When she told me that she works for SimplyVAT I knew I had to have her on as a guest on my blog with a piece about VAT in Europe and how to handle the VAT as an international (or local) seller.

So without further ado, here is Claire’s blog post:

With 71% of shoppers believing they will get a better deal online than in stores, it is no surprise that the global ecommerce industry has developed at a breakneck pace – worldwide B2C ecommerce sales amounted to more than £18 trillion in 2016.

Cross border sales are expected to account for 20% of these sales in 2017, giving online retailers a huge opportunity to increase profits by tapping into overseas markets. You no longer need to conquer your local market before you contemplate world domination; you can operate a successful global business straight away. This new global reach means many issues can catch out the unwary retailer – both new and the more established.

YOUR INTERNATIONAL VAT OBLIGATIONS

Online retailers need to understand which international VAT laws will be relevant to your business. Just because your business is online, normal societal rules of taxation still govern it. In this blog, we provide you with:

- What do you need to think about?

- What exactly are the different VAT rules and regulations?

- What do you need to do to ensure you are VAT compliant?

- And what happens if you don’t comply?

Disclaimer: Some of the products may contain an affiliate link and we may make a commission if you click on it at no additional costs to you.

WHAT IS VALUE ADDED TAX (VAT)

Value Added Tax (VAT) is the preferred transactional tax model in the EU and is equivalent of the USA sales tax. It differs from sales tax though as it is applied every time value is added– from the raw material supplier, to the manufacturer to the wholesaler and retailer and finally to the end consumer.

Governments get revenue every step of the supply chain. It is not supposed to be a burden on businesses, who, once VAT registered, can offset any VAT collected on sales against any VAT incurred on expenditure – including import VAT. The burden rests with the final consumer, and it is for this reason, the EU tax authorities are focusing on catching non-compliant online retailers – the VAT charged on sales to private consumers is revenue the tax authority gets to keep.

WHAT ARE THE EU VAT RULES THAT AFFECT ONLINE RETAILERS?

How you choose to distribute your goods to your customers will have VAT implications for you as the seller. Here we explain which issues affect you:

- Import VAT is applied at the first port of entry into the EU – local import VAT will be charged on the cost value of the goods you are importing, for example, in the UK the import VAT is at 20%.

If you are not VAT registered, your customer is usually left to pay the import charges before they can receive delivery of the goods. This is not really the best customer experience.

If you have an EU EORI (Economic Operator Registration Identification) number (issued by the EU customs authorities) and are VAT registered, you will account for the import VAT:

- You charge the customer the VAT when they buy the goods from your online store so there are no unpleasant surprises for them on delivery. This is paid over to the tax authority on the VAT return.

- The import VAT charged is refunded to you via the local VAT return.

- Using Fulfilment Centres in the European Union

- Wherever your stock is held, whether it be an Amazon fulfilment centre or another third party warehouse – as a non-resident of that country – you now have an obligation to VAT register there. There are no thresholds to exceed.

- If your stock is in fulfilment centres in several EU countries, you will require VAT registrations in each of the countries where your stock is held.

- The EU VAT Distance Selling Rules

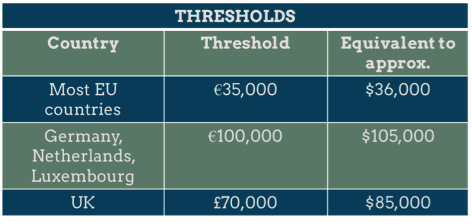

Once you are VAT registered in one EU country, sales delivered from that country to local private customers or customers in other EU countries are governed by the EU VAT distance selling rules. These rules state that local VAT is charged on any sales to any consumers within Europe until the set distance selling thresholds are exceeded in any one country.

The Distance Selling rules do give you a chance to test the European markets without the heavy cost of compliance.

- Monitoring Your Sales

- When calculating whether you have exceeded the threshold, make sure you add sales from EACH channel you sell on – all sales go towards the distance selling thresholds.

- Also include the shipping amount in the calculation.

If you are selling medium to high value goods, it won’t take much for you to breach the threshold in many of the EU countries.

- Other Reporting Obligations

- EC Sales Lists

When stock is sold, or transferred between EU countries, there is additional reporting obligation to file an EC Sales List. For example, if stock is moved from the UK warehouse to a German warehouse, this will need to be reported on an EC Sales List as well as the UK VAT return. This is particularly relevant when using Amazon’s Pan-EU service as stock is moved, by Amazon, on your behalf between 7 different EU countries. (Also note using Amazon’s Pan-EU service triggers VAT registrations in those 7 countries – Germany, France, Italy, Spain, UK, Czech Republic and Poland).

[thrive_leads id=’51377′]

- Intrastat Declarations

Intrastat Declarations are statistical reports that are obligatory once set intrastate thresholds are exceeded in each EU country. There are thresholds for both ‘dispatches’ and ‘arrivals’. See below table:

| Intrastat Reporting ThresholdsCountry | Currency | Arrivals | Dispatches |

| Austria | EUR | 750,000 | 750,000 |

| Belgium | EUR | 1,500,000 | 1,000,000 |

| Bulgaria | BGN | 410,000 | 240,000 |

| Croatia | HRK | 1,800,000 | 900,000 |

| Cyprus | EUR | 100,000 | 55,000 |

| Czech Republic | CZK | 8,000,000 | 8,000,000 |

| Denmark | DKK | 6,000,000 | 4,700,000 |

| Estonia | EUR | 200,000 | 130,000 |

| Finland | EUR | 550,000 | 500,000 |

| France | EUR | 460,000 | More than 460,000: detailed Intrastat; Less than 460,000: simplified Intrastat |

| Germany | EUR | 800,000 | 500,000 |

| Greece | EUR | 150,000 | 90,000 |

| Hungary | HUF | 100,000,000 | 100,000,000 |

| Ireland | EUR | 500,000 | 635,000 |

| Italy | EUR | More than 50,000: monthly Intrastat (EC Purchase listing); Less than 50,000: quarterly Intrastat (EC Purchase listing) | More than 50,000: monthly Intrastat (EC Sales listing); Less than 50,000: quarterly Intrastat (EC Sales listing) |

| Latvia | EUR | 180,000 | 130,000 |

| Lithuania | EUR | 280,000 | 200,000 |

| Luxembourg | EUR | 200,000 | 150,000 |

| Malta | EUR | 700 | 700 |

| Netherlands | EUR | 1,000,000 | 1,200,000 |

| Poland | PLN | 3,000,000 | 1,500,000 |

| Portugal | EUR | 350,000 | 250,000 |

| Romania | RON | 500,000 | 900,000 |

| Slovak Republic | EUR | 200,000 | 400,000 |

| Slovenia | EUR | 120,000 | 200,000 |

| Spain | EUR | 400,000 | 400,000 |

| Sweden | SEK | 9,000,000 | 4,500,000 |

| UK | GBP | 1,500,000 | 250,000 |

| The information produced is for general guidelines only. More specific information, please contact [email protected] | |||

| The information is correct at the 1st January 2017 |

You will need to monitor sales (dispatches), for example, from the UK to any EU countries, once these ‘dispatches’ reach £250,000, intrastat declarations will need to be filed.

- Fiscal Representation – as non-EU company, some EU countries require a non-EU business to have Fiscal Representation. A Fiscal Representative is jointly and severely liable for the VAT owed, and because of this risk, there are additional fees associated which can include a bank guarantee. An option for non-EU companies, to avoid these costs, is to set up an EU company. If an EU company is established there will, however, be other reporting requirements such as a Confirmation Statement and Annual Accounts, however, it is a matter of doing the sums and calculating whether these costs will outweigh the cost of fiscal representation in the countries you will have VAT compliance exposure.

Countries such as France, Italy and Poland, amongst many others, require non-EU companies to have a Fiscal Representative in place.

- Penalties and Fines for Non-VAT Compliance

Ignorance of the VAT rules is no defence. Not accounting for VAT properly or not reporting it at all can cost you your business.

The tax authorities are becoming much more proactive in hunting down non-compliant online sellers as, I mentioned previously, the tax authorities get to keep the VAT revenue collected from online sales.

Recently, the marketplace – Amazon.de – was approached by the German tax authority to provide seller data, and they had to hand it over. At Amazon.fr, Amazon are now obliged to issue each seller with sales through Amazon.fr, with an Annual Summary detailing their sales and potential VAT exposure there; and in the UK, from committed lobbying by UK sellers to close the competition gap from non-compliant, non-EU sellers, the UK tax authority has issued new rules to make the marketplaces and fulfilment centres responsible for their client’s compliance. HMRC now has the power to make Amazon close your store down within 30 days if you are not VAT compliant.

Once caught, the tax authorities will issue penalties and interest charges for late or non-compliance. Is it worth the worry, not to comply?

Don’t let VAT be a barrier to your European expansion plans

Our advice is to plan ahead. Add the cost of VAT compliance to your cashflow along with other staples such as web-hosting or accountancy fees. Understanding the cost of entering a foreign market will ensure your international business will thrive!

It can sound daunting, we understand you don’t have the luxury of a tax department to make sure you are staying ahead of the game, but please don’t be put off by the VAT rules, we are here to help and at www.simplyvat.com we understand the struggles of an entrepreneur.

- We provide an expert, friendly and customer focused service

- We can ensure you are VAT compliant across Europe and elsewhere where local laws are applicable such as Canada.

- We can give you the right country-specific VAT compliance information to make sure your invoices are correct.

- We can make your VAT compliance experience as painless as possible through our new online VAT compliance platform.

- We can get you VAT registered, obtain an EORI number for you; prepare and submit your VAT return, and, if necessary, file your EC Sales Lists and intrastat declarations on time.

- We monitor your distance sales from your multi-channel locations to ensure you stay compliant.

At http://www.SimplyVAT.com We Are Here To Help…. You Sleep At Night..

If you want to know more, please email [email protected] or [email protected] to discuss how we can help you with your international expansion plans.